Worley Parsons (WOR)

To understand how Pythagoras Investing works, we are using this stock as an example.

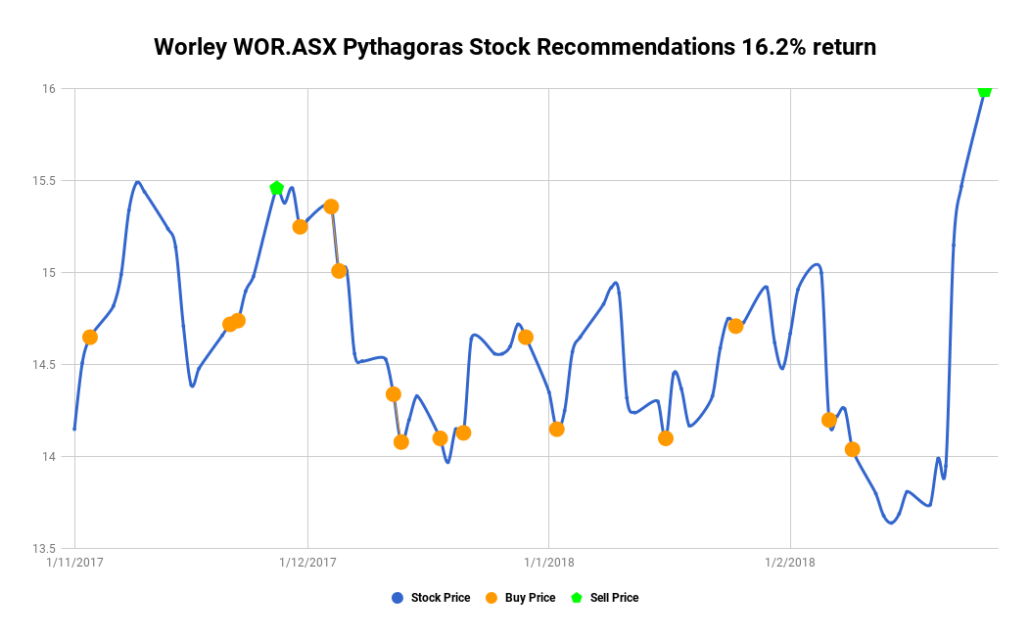

Pythagoras recommendations created a 16.2% return for our customers in the past 3 months. We recommended 16 buys which resulted in an average profit of $1.42 per buy. Over 3 months total capital gain was $22.73. At the same time, Worley Parsons gains $1.31 or 8%. By comparison to the market, the share price or bank interest – this is a great outcome.

Who is Worley Parsons?

Worley Parsons Limited provides professional services to the resources and energy sectors in Australia and internationally. The company provides engineering design and project delivery services, including maintenance, reliability support, and advisory services. The company offers engineering and project management services to the floating production systems, heavy oil and oil sands, offshore topsides, offshore pipelines and subsea systems, onshore pipelines and receiving terminals, onshore oil and gas production facilities, sulphur recovery plants, arctic and cold climate, and unconventional oil and gas facilities, as well as for petrochemicals, refining, and LNG sectors.

It also provides engineering and project services for base metals, coal, chemicals, ferrous metals, alumina, aluminum, iron ore, and gas cleaning industries. In addition, the company offers infrastructure business support services for resource and urban infrastructure markets, including environmental and restoration services, development of water gathering and processing facilities, rail and port assets, and power generation and transmission. WorleyParsons Limited was founded in 1971 by a great guy called John Grill and is based in North Sydney, Australia.

Retail investor is always the last to know

No one really wants to acknowledge that they sit on the reactionary side of trading but it’s something most investors have in common. Investment decisions are usually a reaction to an event.

This is where every investor, big or small, comes unstuck. Trying to react after the horse has bolted is a flawed investment strategy.

How do you overcome trading after the event?

Unless you are capable of analysing the mountains of data, you’re in for a tough emotional rollercoaster trading stocks. How much of your time do you dedicate to researching and predicting stock prices? Whatever the answer is, it’s never enough.

How is Pythagoras different?

What if you traded before the event? How about buying before or at the start of a price rise? What about selling when the price is about to peak before the downturn? All with mathematical precision.

Pythagoras is looking when everyone else isn’t. And it’s doing more than the human mind can – without prejudice and human emotion.

Simply put, Pythagoras is mathematically looking at stocks and predicting events through changes in volatility. We then predict share price behaviour – and trade ahead of the events.

We are not scared of volatile markets as Pythagoras mathematically performs at its best in difficult markets. There is no need for fear! It predicts the events and buys or sells ahead of them!

Buy signals with a price and timing, and sell signals with timing!

How does it work?

Our predictive technology takes a complex snapshot of each stock’s historic performance and measures volatility, allowing us to predict events that will affect the stock price.

Pythagoras has simplified investing, making it manageable even for casual investors. We give you back freedom from watching and worrying about the market!

Be ahead of the whole market with Pythagoras!

You get to act before price-sensitive events. Be ahead of the market with a better return for a fraction of the time and effort.

No more tedious annual reports, stockbrokers research, economic papers or expensive subscriptions.

How Do You Invest?

Don’t be the last to know – get ahead of the crowd using Pythagoras Investment Timing Indexes. Our website has all the information to show you how Volatility can be utilised to alleviate the tension and improve your life when investing.

-

Email Address:

- First Name:

- Last Name:

Disclaimer: The information in this document (“Information”) is not intended to constitute advice. It is for general information only and does not take into account your individual objectives, financial situation or needs. You should assess whether the information is appropriate for you and seek professional financial advice before relying on or making investment decisions based on the Information. Investment products are subject to risk including the loss of income or capital invested. Past performance is not an indicator of future performance. Neither Pythagoras Investment Timing Index Pty Ltd ACN 147371113 (AFSL 431 238), its directors, employees and representatives (collectively, “Pythagoras”) warrant the accuracy or completeness of the Information. To the extent permitted by law, Pythagoras disclaims all responsibility and liability for any loss or damage of any nature whatsoever which may be suffered by any person directly or indirectly.