What they do?

- Star Entertainment Group has just downgraded earnings – this blog will explain more about the downgrade and its effect rather than the reasons behind it.

- The Star Entertainment Group operates The Star in Sydney, The Star Gold Coast and Treasury Casino & Hotel in Brisbane. The Company also manages the Gold Coast Convention and Exhibition Centre.

What was the confession?

- Domestic revenue growth has slowed, and International VIP visitation/spend remained tough.

- It’s full-year earnings before interest tax depreciation and amortisation (EBITDA) are estimated by the company to be $555 million – around 2.3 per cent below 2018.

Why the price fall?

- Ideally, investors would have been selling ahead of the downgrade to buy back at lower prices – without any behavioural price anchoring or a distaste for the stock.

- Whist they still earn a lot of money from operations and will pay a decent dividend the change in earnings guidance was a price killer. The stock price took a hammering – down 16% on the day. Now that’s a big move. The reason lies in the future earnings of the stock. Here is where earnings expectations play such an important role. The price of the stock is based on future earnings. The domestic and international visitors trend was worrying enough for the management to downgrade earnings expectations – 19 days before the end of year! Moreover, what is this saying for 2020 earnings?

What is the effect?

- The stock price leading up to June 11 was approximately $4.45-4.50. The market earnings expectation for the 2019 year was $600m EBITDA, up from $568 last year. That is a reasonable growth of 5.5% added to a dividend expectation of around 4.5-5.0% – looking like a solid total return.

- Now, company guidance for FY2019 of $550-560m EBITDA just before the year end is prompting questions about the speed of the decline, communication from the company and the confidence about earnings quality.

- The downgrade to expectations for 2019 and 2020 caused the share price to drop 16% – well ahead of the earnings downgrade of 8%. The question becomes will the confidence be recaptured and the derating recouped?

What did Pythagoras do?

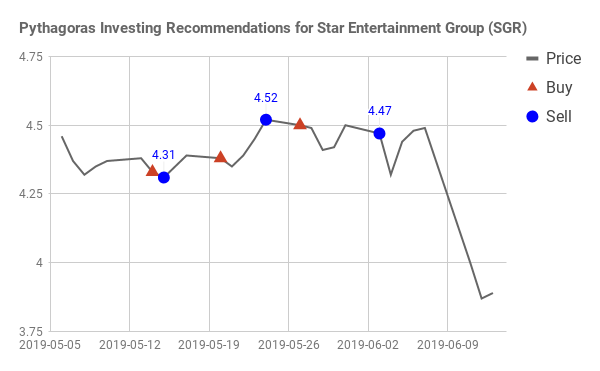

What I am pleased to show is that Pythagoras predicted the price sensitive event and sold at $4.47 on 3 June. That sell was less than 1 week before the downgrade on 11 June whereup the price dropped to $3.79.

Capital saved by selling – ready for action!

The share price in SGR had been moving sideways for months without a significant trend. Pythagoras has outperformed the stock – and now by 18% post the downgrade. But what is important is that our clients have saved their capital from this loss.

Be ahead of the market with Pythagoras!

Act before price-sensitive events and be ahead of the market with a better return for a fraction of the time and effort. No more tedious annual reports, stockbrokers research, economic papers or expensive subscriptions. Buy signals with a price and timing, and sell signals with timing!

Don’t be the last to know – get ahead of the crowd and ride the wave with Pythagoras.

Disclaimer: The information in this document (“Information”) is not intended to constitute advice. It is for general information only and does not take into account your individual objectives, financial situation or needs. You should assess whether the information is appropriate for you and seek professional financial advice before relying on or making investment decisions based on the Information. Investment products are subject to risk including the loss of income or capital invested. Past performance is not an indicator of future performance. Neither Pythagoras Investment Timing Index Pty Ltd ACN 147371113 (AFSL 431 238), its directors, employees and representatives (collectively, “Pythagoras”) warrant the accuracy or completeness of the Information. To the extent permitted by law, Pythagoras disclaims all responsibility and liability for any loss or damage of any nature whatsoever which may be suffered by any person directly or indirectly.