Afterpay (APT) is growing its customer base, merchant numbers and revenue very fast. It is loss making but is close to breakeven with a market capitalisation of $8bn. It is expanding into offshore markets and building a platform for future growth.

It has issues of fast growth and currency to deal with. The competitive landscape is a moving feast with gorilla threats in Visa, Mastercard & Paypal.

The founding shareholders have sold down their holdings at the same time Afterpay is facing an AUSTRAC audit which is in respect of its AML/CTF compliance. This audit is due to begin 24 September with the final audit report due by 23 November 2019.

The share price has been working through a $300m+ capital raising and the disappointment of a deferred SPP (shareholder purchase plan).

Few Australian listed companies are growing strongly, let alone 20%+ per annum revenue growth. Afterpay shines as a rare growth company against a back drop of low growth. But experts have said investors need to throw out the valuation textbook to value it – presumably to get anywhere near the current share price.

This is a very complicated stock with a lot of big issues surrounding it.

Behavioural Biases

Behavioural finance tells us a lot about investors’ behaviour. Behavioural biases are the way individual investor beliefs (based on emotion and/or thought) effect of them when making investment decisions. Every one of these Afterpay issues brings up behavioural biases in each investor differently.

Biases are being fed in all the time by media and advisors. You may not think you are effected by investor biases, but if you are reading or listening to others views – who have their own biases – you are effected like it or not.

As humans we are hardwired to be emotional. It’s the one thing we shouldn’t be if we want to be great investors. Using Afterpay we can consider some biases so you may understand your own.

Worry

Worry is a behavioural bias where the effects aren’t widely acknowledged. Worry is a normal reaction – it can be healthy in small doses. But in the extreme it alters our investment judgement. Anxiety from worry causes us to alter our “normal” risk tolerance. In this case it will cause people to pull back from considering an investment in Afterpay – which will have been learnt investing in Afterpay or another stock (even in another time).

Ignoring Probability

Another behavioural bias is ignoring probability when making investment decisions. People use best case assumptions in their decision making which causes investment mistakes – as low probability events can and do happen. The competitive landscape for Afterpay would be an example of an event eg what are the chances of Visa seriously entering this market? What are the chances of a competitor making a takeover bid for Afterpay?

Herd Mentality/Group Think

Herd mentality is an investor bias which refers to a tendency to follow and copy what other investors are doing. It’s built into our makeup – there is safety in numbers. Herd mentality works when being chased by a dinosaur but isn’t so handy as an investor. When herd mentality gets a hold of it, the Afterpay price moves fast – up and down. Investing with the herd can leave us high and dry – and selling at a loss.

To fight those behavioural finance issues Maths is a great weapon.

Volatility

Volatility is a statistical measure of the dispersion of returns for a given stock. In most cases people believe the higher the volatility, the riskier the security.

In the past 300 trading days the Afterpay price has moved greater than +/-5% on 67 days – that’s a 1 in 5 chance. Similarly, the price has moved more than +/- 2.5 % on 164 days – that’s a 1 in 2 chance. Now that is clearly a wild price ride.

On any traditional measure of volatility Afterpay is a risky stock. Pythagoras is attracted to volatile situations most shy away from – it is most at home in volatile stocks and markets!

Pythagoras: Using Volatility to Profit

Pythagoras overcomes investor biases using Maths! It does this by predicting events and price behaviour and buying or selling ahead of it. By doing this it takes care of the complex analysis of investing and enables the average person with little knowledge to be as successful as an expert.

Since the earliest times the only way to work out difficult issues was by using Maths – Pythagoras (the ancient Greek mathematician) himself believed all issues could be solved using Maths.

While most fear stock market cycles – even though there are many cycles per year – Pythagoras is attracted to them. By using volatility Pythagoras excels during the price cycles – using them to profit.

Pythagoras and Afterpay

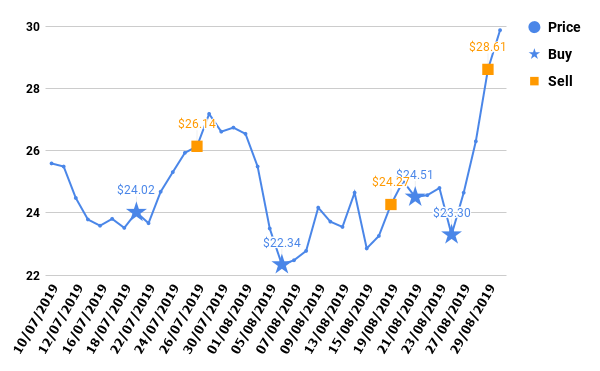

When Pythagoras Investment Timing Indexes are applied to Afterpay for those same 300 days Pythagoras made 8 sell recommendations and 56 buy recommendations. Of those buys, 12 exceeded the price tolerance given– so we don’t count those. Of the remaining 44 recommendations the results are as follows:

| Recommendations | Number | Average Return |

| Profitable Buys | 29 | 10.5% |

| Unprofitable Buys | 15 | -8.3% |

The average investment period is 36 calendar days with an average win:loss rate of 66%. The win average gain is higher than the losses. There were only 8 sells – which means we have 5.5 buys to every sell for Afterpay. In doing this we are “diversifying” into the stock.

By using the price cycles and predicting price behaviour Pythagoras is able to turn a volatile stock most wouldn’t touch into a golden opportunity as displayed below.

Disclaimer: The information in this document (“Information”) is not intended to constitute advice. It is for general information only and does not take into account your individual objectives, financial situation or needs. You should assess whether the information is appropriate for you and seek professional financial advice before relying on or making investment decisions based on the Information. Investment products are subject to risk including the loss of income or capital invested. Past performance is not an indicator of future performance. Neither Pythagoras Investment Timing Index Pty Ltd ACN 147371113 (AFSL 431 238), its directors, employees and representatives (collectively, “Pythagoras”) warrant the accuracy or completeness of the Information. To the extent permitted by law, Pythagoras disclaims all responsibility and liability for any loss or damage of any nature whatsoever which may be suffered by any person directly or indirectly.