In the face of new trade sanctions and a U.S. move on Chinese telecommunications companies, China issued a pointed reminder that they have move moves up their sleeve to retaliate against the Trump administration.

The threat to use China’s rare earths as leverage in the negotiation with the USA. The state media warned that China could stop exporting rare earths to the USA. These minerals are used in (for example) electric cars and mobile phones. It is not new – China used this tactic last in 2009.

Australian listed Lynas (LYC.AX) produces Rare Earths concentrates at Mt Weld. It also produces and sells Rare Earth products from the LAMP in Malaysia. The share price has been volatile with disputes with Malaysian authorities. Pythagoras returns have been remarkable.

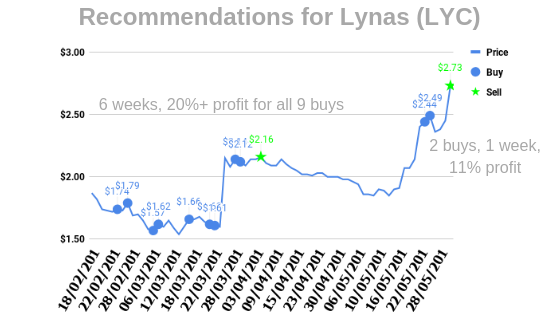

From mid-February 2019 there were 9 buys until the sell in early April. When the sell came on the 4th of April each of the 9 buys was profitable to the tune of 20%+ each. 9 opportunities to buy, over 6 weeks, average return more than 20% each.

The buying was ahead of the Wesfarmers approach on 27 March 2019. The selling occurred in the middle of the announcements about Wesfarmers and the Malaysian Regulatory update.

For about 6 weeks Pythagoras sat on its hands as the share price (mostly) flailed until a change in share price behaviour was predicted by our system – buying occurred as a positive was afoot. There were 2 buys on the 23rd and 24th of May 2019.

When China made the world aware that they could withhold rare earths from the US, LYC then jumped in anticipation of a positive longer term effect. On the 30th of May, those buys 1 week before were sold at a price of $2.73 and a profit per buy of 10.8%

Pythagoras predicts share price changes about to occur, and trades ahead of them. LYC.AX illustrates this in spades.

Pythagoras is looking when everyone else isn’t. And it’s doing more than the human mind can – without prejudice and human emotion. Simply put, Pythagoras is mathematically looking at stocks and predicting events through changes in volatility. We then predict share price behaviour – and trade ahead of the events.

We are not scared of volatile markets as Pythagoras mathematically performs at its best in difficult markets. There is no need for fear! It predicts the events and buys or sells ahead of them! This is a revolutionary method of accumulating wealth.

Pythagoras has simplified investing, making it manageable even for casual investors. We give you back freedom from watching and worrying about the market!

Be ahead of the whole market with Pythagoras!

You get to act before price-sensitive events. Be ahead of the market with a better return for a fraction of the time and effort. No more tedious annual reports, stockbrokers research, economic papers or expensive subscriptions. Buy signals with a price and timing, and sell signals with timing!

Don’t be the last to know – get ahead of the crowd and ride the wave with Pythagoras.

Michael Dee, 0419 726223

Disclaimer: The information in this document (“Information”) is not intended to constitute advice. It is for general information only and does not take into account your individual objectives, financial situation or needs. You should assess whether the information is appropriate for you and seek professional financial advice before relying on or making investment decisions based on the Information. Investment products are subject to risk including the loss of income or capital invested. Past performance is not an indicator of future performance. Neither Pythagoras Investment Timing Index Pty Ltd ACN 147371113 (AFSL 431 238), its directors, employees and representatives (collectively, “Pythagoras”) warrant the accuracy or completeness of the Information. To the extent permitted by law, Pythagoras disclaims all responsibility and liability for any loss or damage of any nature whatsoever which may be suffered by any person directly or indirectly.