Pythagoras leads the market in predictive investment knowledge

We provide stock recommendations that are ahead of the rest of the market using our mathematical predictive logic that allows us to predict future share price moves.

Working with Pythagoras: Predicting Events

Pythagoras makes investing easy!

Buy and sell recommendations are emailed to our clients for their chosen stocks during the middle of the day – to be actioned that day. Each buy comes with a price or price range. Each sell comes with timing – not a price.

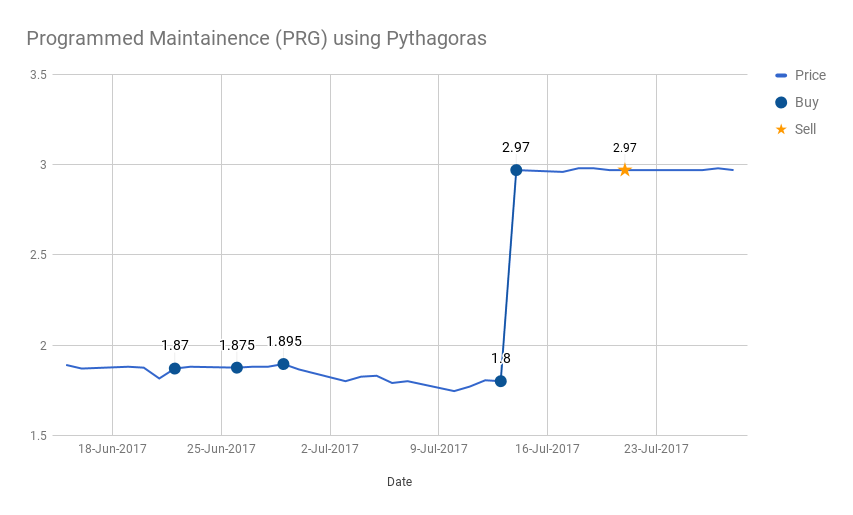

Currently there are 75 Australian listed stocks to choose from and Programmed Maintenance (PRG) is one of those. In today’s blog we explain how Pythagoras recommendations worked for Programmed Maintenance (PRG) leading up to a critical event.

Buying Sequence

In late June 2017, Pythagoras recommended a new sequence of buys. The first email sent to the client was as follows: “22/6/2017 – PRG: Program Maintenance, buy between $1.86 and $1.92, actionable today.”

There were 3 buys in a 7 day period – we have summarised them below.

Date Recommendation Buy Price Range Transacted Buy Price

22/6/2017 Buy 1.86-1.92 1.87

26/6/2017 Buy 1.85-1.86 1.85

29/6/2017 Buy 1.87-1.96 1.895

The client would then continue to wait for the next recommendation.

The next buy recommendation was on 13/7/2017 at $1.79. Then another buy on the 14/7/2017 at $3.01.

Date Recommendation Buy Price Range Transacted Buy Price

22/6/2017 Buy 1.86-1.92 1.87

26/6/2017 Buy 1.85-1.86 1.85

29/6/2017 Buy 1.87-1.96 1.895

13/7/2017 Buy 1.79-1.84 1.80

14/7/2017 Buy 3.01-3.16 2.97

Event Predicted

On the very same day as the last buy (14/7/2017) there was an announcement by the company that it had entered into a Scheme Implementation Deed with a company called PERSOL holdings to buy 100% of PRG for $3.02. An event!

Predicting Events with Share Price Effects

No-one else can mathematically predict share price behaviour and act in advance of a share price event! Unlike all its competitors, Pythagoras is not re-working pre-existing information. This is entirely new knowledge using logic that has not previously been known, understood or available which gives you the opportunity to be ahead of the market using our revolutionary mathematically precise, predictive technology.

A subscriber to this stock would have bought 5 times and received a sell recommendation on 21/7/2017 at $2.97. Summarised below is the sequence of buying and the sell recommendation. Its wildly profitable!

Date Recommendation Buy Price Range Transacted Buy Price Sell Price Profit per buy

22/6/2017 Buy 1.86-1.92 1.87 1.10

26/6/2017 Buy 1.85-1.86 1.85 1.12

29/6/2017 Buy 1.87-1.96 1.895 1.08

13/7/2017 Buy 1.79-1.84 1.80 1.17

14/7/2017 Buy 3.01-3.16 2.97 0.00

21/07/2017 Sell 2.97

We have graphically represented these to aid your understanding.

Given the price reaction, the takeover came as a shock to the market. In contrast Pythagoras Volatility was all over it – having bought 5 times ahead of what was a significant event. The average buy price would be $2.07 for the 5 buys over the 3 week period. Upon selling they would have made 41% return, in 1 month! Quite remarkable I am sure you will agree.

Given the price reaction, the takeover came as a shock to the market. In contrast Pythagoras Volatility was all over it – having bought 5 times ahead of what was a significant event. The average buy price would be $2.07 for the 5 buys over the 3 week period. Upon selling they would have made 41% return, in 1 month! Quite remarkable I am sure you will agree.

How does it work?

Our predictive technology takes a complex snapshot of each stocks historic performance and measures volatility, allowing us to predict events that will affect the stock price. For Programmed Maintenance this was a takeover – but there are a multitude of events which affect share prices of stocks every day.

We have simplified investing, making it manageable even for casual investors. We give you back freedom from watching and worrying about the market!

Be ahead of the whole market with Pythagoras!

You get to act before price sensitive events. Be ahead of the market with a better return for a fraction of the time and effort.

No more tedious annual reports, stock brokers research, economic papers or expensive subscriptions.

How Do You Protect Yourself ?

Don’t be the last to know – get ahead of the crowd using Pythagoras Investment Timing Indexes. Our website has all the information to show you how Volatility can be utilised to alleviate the tension and improve your life when investing, especially when the going is hard like it was in the GFC 1.

How did you fare in financial year 2008/2009 when the return for the stock market was -24% ? In that terrible year, for the 70+ stocks Pythagoras is currently offering, our recommendations returned +12% – a massive 36% better. This could have been you.

Our 5 year returns are worth a look.

Conclusion: The Key to Making Money is Selling.

The key to making money in any market is selling before any negative event. Pythagoras generates the sells before the events with share price effects – its proactive not reactive.

Investors know it’s rare for all stocks to go down all the time, all at once. Even in a bear market there are upward moves to profit from – if you have the right buy/sell recommendations.

Therefore Pythagoras can make money in any market regardless of the investment environment – in fact it’s best in the tough markets. We worry less about the events and their timing and focus on Volatility changes. At Pythagoras we follow changes in Volatility which precede the events. This places us at the forefront of investing.

Brendan is available on 0433 726 888 to discuss how we can assist to release you from the worry of investing and get you back to enjoying life.

-

Email Address:

- First Name:

- Last Name:

Disclaimer: The information in this document (“Information”) is not intended to constitute advice. It is for general information only and does not take into account your individual objectives, financial situation or needs. You should assess whether the information is appropriate for you and seek professional financial advice before relying on or making investment decisions based on the Information. Investment products are subject to risk including the loss of income or capital invested. Past performance is not an indicator of future performance. Neither Pythagoras Investment Timing Index Pty Ltd ACN 147371113 (AFSL 431 238), its directors, employees and representatives (collectively, “Pythagoras”) warrant the accuracy or completeness of the Information. To the extent permitted by law, Pythagoras disclaims all responsibility and liability for any loss or damage of any nature whatsoever which may be suffered by any person directly or indirectly.